Due Dilligence for IT

- IT fitness for the role?

- Considering M&A or divestment?

- Outsourcing of IT-services?

Assess IT Fitness

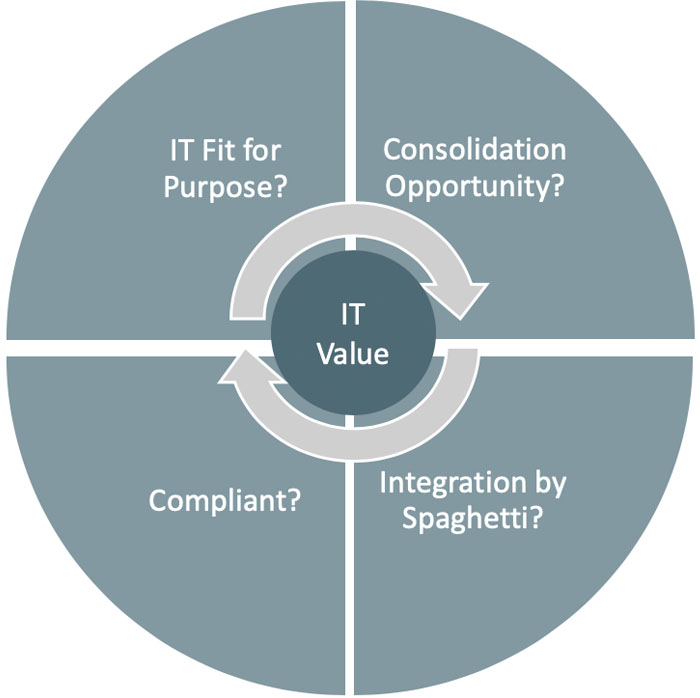

Aligning business and IT when developing the IT roadmap and investment strategy forms a strong foundation. However, close collaboration between business and IT, flexibility, and cost-consciousness are key. Examining the IT project portfolio can reveal crucial insights, such as trends of project delays or budget overruns. Understanding the root causes, such as skill shortages, is vital.

Our governance assessment helps to gauge the efficiency of cooperation between business and IT, as well as the potential for cost take-out by IT consolidation.

Consolidation Opportunity

The IT industry evolves rapidly, making it challenging to predict which technologies will bring the most business benefits. A thorough analysis of technology adoption, support, and alignment with your business strategy is essential. Consider your people strategy, skills availability, and potential outsourcing of services.

Our assessment helps identify IT debt and assess the applicability of critical IT systems. We can guide you on upgrading and replacing on systems and infrastructure , identify skills gaps, and assess outsourcing options.

Integration Complexity

Over time, system integration can become complex, affecting ability to change. Poorly designed integration platforms can hinder ability full fill business needs. Actensa can assist in understanding the implications of separating core systems and guide platform replacements or rebuilds.

Compliance:

Adherence to industry and legal regulations is crucial. Non-compliance can result in financial penalties and damage your company’s reputation.

Actensas experience in operational risk reduction supports you in implementing appropriate safeguards and assessing IT-operational risk levels. Thus minimising the risk for being off-set to negative business impact as well as penalties.

The Actensa Advantage

With a background in leading IT companies like Accenture, IBM, and DELL/EMC, Actensa consultants has a proven track record for providing capability in maximizing IT investments across industries.

We offer:

- Comprehensive Insights: We identify the potential and weaknesses of your target company using tested tools and methodologies.

- Clear Recommendations: We provide easy-to-understand reports for senior stakeholders, articulating findings and recommendations.

- Rapid Value Delivery: We quickly ramp up and strive to ensure your investment pays off. Actensa provides the facts and support you need to make informed decisions in the world of IT due diligence.

Project Experiences (none extensive):

Business Continuity Establishment >>

Garantum >>

Operational Risk Program >>

Actensa, Ulrik Sturk, LinkedIn >>